Portfolio Overview

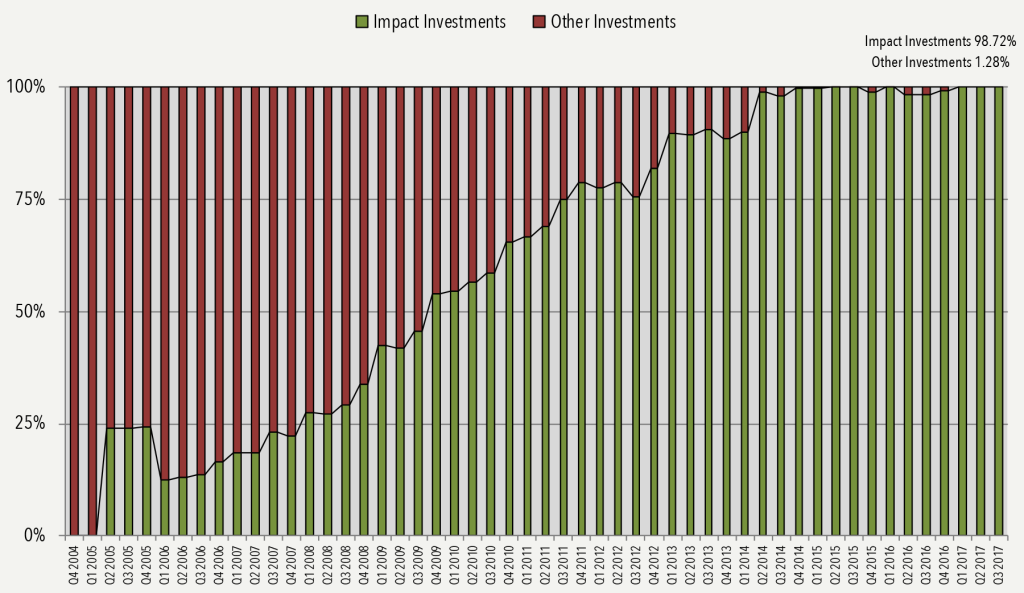

As of Dec. 31, 2016, 99.5% of the KLF portfolio is in impact investments.

Categories of the impact investing spectrum

- Responsible: Consideration of ESG risks to screen out investments

- Sustainable: Targeting investments best positioned to benefit from the integration of ESG factors

- Thematic: Focus on issue areas where social or environmental needs offer commercial growth opportunities for market rate return

- Impact First: Emphasis on the optimization of social or environmental needs, which may result in financial trade-off

Since 2006, the Foundation has steadily increased the number of Impact Investments in its portfolio. Impact First Investments consist of Program Related Investments and Corpus Impact First Investments.

Grants are also an integral part of the Foundation’s impact investing strategy. Grants are typically made alongside investment support to early-stage enterprises that require some subsidy or capacity building assistance in preparation for scaling social impact.

Read more about the Foundation’s grants here.