Performance

KL Felicitas Foundation Investment Portfolio Impact Report

In Pursuit of Deep Impact and Market-Rate Returns: KL Felicitas Foundations Journey is a deep-dive analysis of the KL Felicitas impact investment portfolio, which provides a model strategy for achieving targeted social and environmental as well as financial returns. The report, released in April 2018, by New Philanthropy Capital, Sonen Capital and the Foundation, also shows that use of NPC’s new Impact Risk Classification framework enables rigorous impact measurement across asset classes.

The research draws lessons from the Foundation’s pioneering impact portfolio that can benefit a broad range of investors, from small family foundations to large institutions, and from those just embarking on impact investing to those well on their way to building an impact portfolio.

Key highlights include:

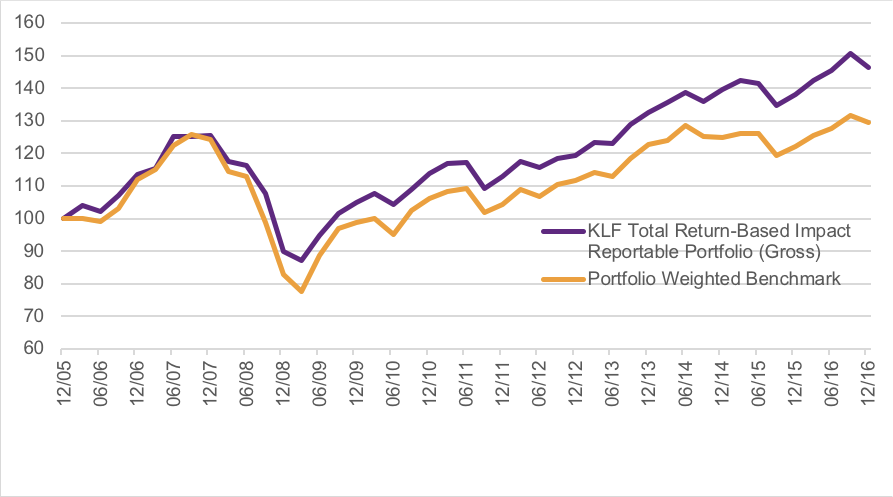

- The $10 million portfolio is 99.5% committed to impact investments, and its return-based impact investments have delivered a 2.75% annualized net financial return through Dec. 31, 2016, since its inception in January 2006. This beats the industry portfolio-weighted benchmark by 37 basis points.

- Measuring and comparing impact across asset classes is possible and relatively easy, using NPC’s impact measurement framework, which includes its Impact Risk Classification tool.

- Foundation investees are contributing to 16 of the U.N.’s Sustainable Development Goals, and the majority of them are delivering on their own impact goals.

- The impact practice of the portfolio overall has improved since 2015.